Tickmill Review – Leading Forex Broker

Forex is the largest market within the financial industry and it never stops growing. There are assets worth over trillions of US dollars traded every day on the market with the number of traders increasing rapidly. It is not surprising why we observe new brokerage firms entering the market regularly, as the business in Forex is highly profitable. However, not all of the brokers can be trusted. There are crucial factors that the traders should take into account when choosing the broker. In order to avoid trading with non-legit firms and losing money, it is advisable to go through the reviews on brokers.

The following review will study one of the most prominent Forex brokers, Tickmill Ltd which appeared on the market back in 2014. Since then, the broker attracted hundreds of thousands of traders and currently operates 350,000 live accounts on its trading platform. We will closely examine the reasons behind the broker’s popularity and see what the broker has to offer to various types of traders.

Is Tickmill Legit?

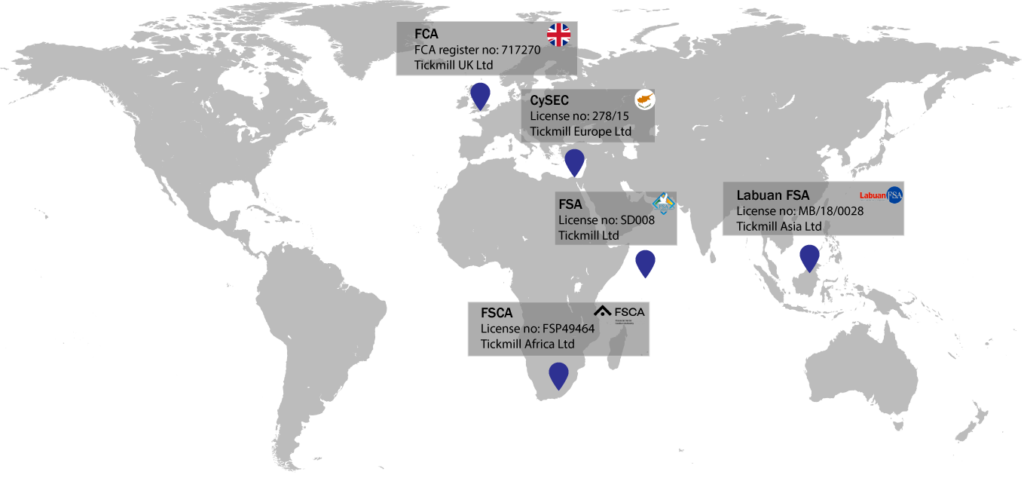

We check the legitimacy of the broker through the regulations, licenses, and recognitions that the broker holds. Tickmill is part of the international company Tickmill Group which unites several brokerage firms under the same brand name. All of the brokers under this parent company hold licenses from multiple regulatory bodies across the globe. These regulations guarantee the safety of the client funds that traders deposit with the brokers through various tools, such as a regular financial audit of the brokerage firms.

Regulatory Framework

Thanks to the multi-regulatory framework of the company, clients from all over the world can safely access and use the services presented by the broker. Below is the list of the regulatory bodies that authorized brands under the Tickmill Group and the geographic location of the firms.

- Financial Services Authority (FSA) – Tickmill Ltd, Seychelles; license number: SD008

- Financial Conduct Authority (FCA) – Tickmill UK Ltd, United Kingdom; FCA register number: 717270

- Cyprus Securities and Exchange Commission (CySEC) – Tickmill Europe Ltd; license number: 278/15

- Labuan Financial Services Authority (Labuan FSA) – Tickmill Asia Ltd; license number: MB/18/0028

- Financial Sector Conduct Authority (FSCA) – Tickmill South Africa (Pty) Ltd; license number: FSP 49464

Company Awards

Apart from the licenses from regulatory authorities that Tickmill Group brokers hold, the company has received a number of awards throughout the past few years. The broker gained a reputation as a reliable, transparent, and superior brokerage services provider. Tickmill Forex broker earned over 15 industry awards in various nominations by some of the most reputable publications and institutions of the financial sector. The list of the awards includes:

Apart from the licenses from regulatory authorities that Tickmill Group brokers hold, the company has received a number of awards throughout the past few years. The broker gained a reputation as a reliable, transparent, and superior brokerage services provider. Tickmill Forex broker earned over 15 industry awards in various nominations by some of the most reputable publications and institutions of the financial sector. The list of the awards includes:- #1 Broker for Commissions and Fees – ForexBrokers.com Annual Forex Broker Review, 2021

- Best Commodities Broker – Rankia Markets Experience Expo, 2020

- Most Reliable Broker – Online Personal Wealth Awards, 2020

- Best Trading Experience – Forex Brokers Award, 2020

- Best Forex Education Provider, Global Brands Magazine

- Best Forex Execution Broker – CFI.co Awards, 2019

- Best CFD Broker Asia – International Business Magazine, 2019

- Best Trading Platform Provider – FxDailyInfo.com Broker Awards, 2019

- Best Forex CFD Broker – Jordan Forex Expo Awards, 2018

- Most Trusted Broker in Europe – Global Brands Magazine, 2017

What can you trade with Tickmill?

Tickmill administers more than eighty financial instruments within the company’s portfolio that range from Forex to various CFDs. The main advantage of the broker over its competitors is the trading strategy allowance of any kind. The traders can apply their unique trading style to any of the products provided by the broker, including hedging, scalping, and EAs. More details on each of the product categories within the portfolio are explored below.

Forex

The traders at Tickmill can access over 60 currency pairs on the trading platform, including some of the most popular and/or exotic currencies. The spreads on the Forex product begin from 0.0 pips. The leverage applicable to Forex assets can go maximum up to 1:500. The average execution speed is 0.20 seconds. There are no commissions applicable in general to Forex instruments. All trading strategies are allowed with Forex, including scalping, hedging, and EAs.

Stock Indices

There are over 10 stock indices available within the trading instruments portfolio of Tickmill. Some of the most demanded indices are included, as well, such as US500 and UK 100. The spreads on stock indices start from 0.0 pips. The maximum leverage available for Stock Indices assets can go up to 1:100. The instruments can be traded without an additional commission fee. The average execution speed of overs on Stock indices trading is 0.20 seconds. All strategies are allowed.

Precious Metals

In addition to Forex and Stock Indices assets, Tickmill broker also provides Precious Metals in its portfolio. The assets include Gold and Silver crosses, which are the most popular instruments traded today within the category of Precious Metals. The leverage applicable for these products can go up to 1:500. The spreads start from 0.0 pips. Once again, there are no restrictions to choosing a trading style or strategy, with EAs, hedging, and scalping all allowed.

In addition to Forex and Stock Indices assets, Tickmill broker also provides Precious Metals in its portfolio. The assets include Gold and Silver crosses, which are the most popular instruments traded today within the category of Precious Metals. The leverage applicable for these products can go up to 1:500. The spreads start from 0.0 pips. Once again, there are no restrictions to choosing a trading style or strategy, with EAs, hedging, and scalping all allowed.

Bonds

Bonds are one of the most popular trading instruments in almost every region of the world. Due to that reason, surprisingly to many, the market on bonds is much larger than the stock market. Tickmill offers four different European bonds within its catalogue of financial instruments, including special access to German bonds. The spreads start from 0.0 pips. The maximum leverage applicable to bond assets is 1:500. The average execution speed of orders is 0.20 seconds.

Bonds are one of the most popular trading instruments in almost every region of the world. Due to that reason, surprisingly to many, the market on bonds is much larger than the stock market. Tickmill offers four different European bonds within its catalogue of financial instruments, including special access to German bonds. The spreads start from 0.0 pips. The maximum leverage applicable to bond assets is 1:500. The average execution speed of orders is 0.20 seconds.

Account Types at Tickmill

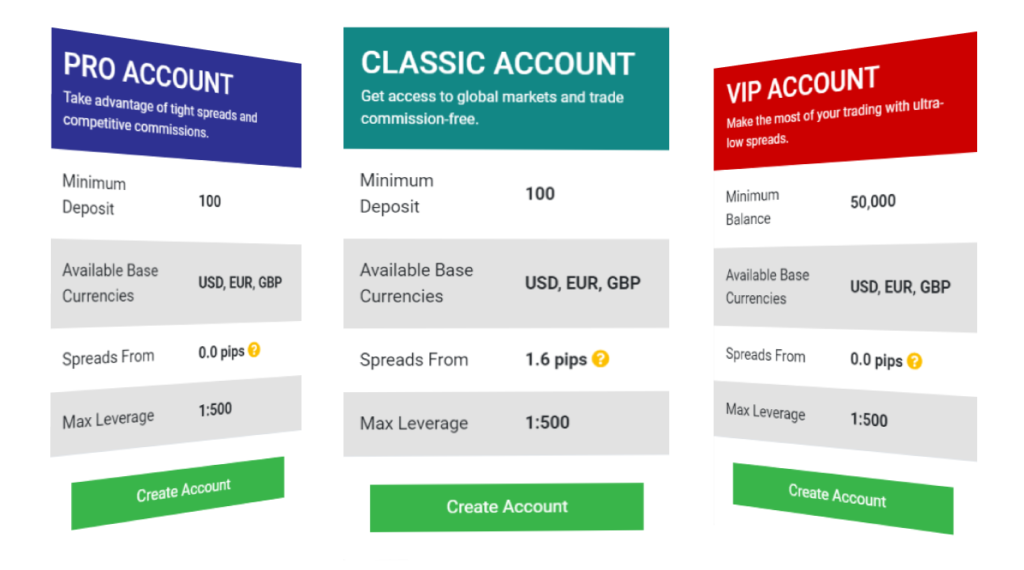

Every decent broker knows that a single account type cannot suit all different kinds of traders today. As the world progresses, people learn more about various trading styles that involve different spread levels, flexibility in leverages or commission amounts, and so on. Therefore variety in the types of accounts is one of the essential components of the best Forex broker. Tickmill offers three account types, which is not much but is sufficient to satisfy most of the client categories in terms of trading strategies and styles.

Classic Account

In order to set up a Classic account at Tickmill, traders need to make an initial deposit of 100 US dollars. The spreads for this account type start at 1.6 pips. There is no commission fee for the trades on the Classic account. The maximum leverage can go up to 1:500. The base currencies available are USD, EUR, and GBP. The account also allows a Swap-free Islamic account option.

Pro Account

Designed for professional and experienced traders, the Pro account of Tickmill offers its traders the experience with the spreads starting from 0.0 pips. However, commission fees are applicable. The commission payable is 2 per side per 100,000 traded. The average execution speed of the orders is 0.20 seconds and all trading strategies are allowed. The leverage and base currencies are the same for Pro account holders.

VIP Account

VIP Account was set for the premium users of the brokerage platform who look for both low spreads and low commission levels. The spreads for VIP account holders also begin at 0.0 pips. The commission fee is 1 per side per 100,000 traded. The maximum leverage can be 1:500. VIP Account also allows the option of a Swap-free Islamic account. The execution speed and trading strategy allowance remain the same for VIP account holders.

Trading Platforms

Tickmill provides the most popular trading platform option for its customers. MetaTrader, which is recognized as the best Forex trading platform can be accessed both as downloadable software and as a web version for Tickmill traders. The WebTrader supports the original MetaTrader 4 with all of its features included, while requires no downloading or installation and can be accessed from any browser. Apart from the simple accessibility of the WebTrader, the platform is also exclusively user-friendly with a simple interface. Furthermore, Tickmill broker guarantees the security of every trader’s private and financial on the platform by implementing extra safety features.

Reward Campaigns of Tickmill

Last but not least, we should review the promotional material that the broker offers to its clients. Surprisingly, there are quite a few reward programs available for the traders, no matter whether they are existing, loyal customers, or novices to the platform. Tickmill introduces four promotional schemes from different categories and all of them come with special treats and opportunities for the traders. The offerings include no deposit bonus of 30 USD, FNP machine campaign held weekly, The Trader of the Month contest, and IB Global Championship held every year.

No deposit bonus can be claimed by every user that registers on Tickmill’s trading platform and goes through the verification procedure. There is no requirement for any deposits in order to be eligible for the program. After setting up an account, the bonus amount of 30 USD will be credited to the trading account of the client within 24 hours. The profits generated from trading with the bonus amount also belong to the traders.

FNP machine campaign runs every week and there is no special rule on eligibility. At the beginning of the NFP week, Tickmill will announce one instrument and the users have to guess the price of the instrument within 30 minutes from the announcement. The trader who gets the price correctly will be rewarded with 500 USD. If there are no correct guesses, traders with the closest bet will receive a 200 USD cash prize instead.

The trader of the month is a performance-based contest where the best trader will be receiving 1000 USD. The winner is decided according to overall trading performance within the given month including the profit generated through trades, the total amount of deposits made, and the risk management of the money.

IB Global Championship unites Introducing Brokers and encourages them to get new traders to register on the Tickmill trading platform. In Tickmill opinion this is the most efficient way to reward referrals. The prize pool is 65,000 USD in cash. The participants or IBs accumulate points by inviting new traders to the broker’s platform. The more new registering users trade with the broker, the more points IBs receive.