PipFarm Review — A promising prop firm offering many opportunities and bonuses

PipFarm Forex proprietary trading firm is a young prop firm allowing traders to speculate on financial markets using the firm’s capital. Since the firm is giving its capital to traders, it also has several risk management rules and an evaluation phase to ensure only profitable traders are allowed to access funded accounts. This is a very unique model and allows good traders to make good profits and keep 90% of these profits made in trading activities using the firm’s money. PipFarm is operated by ECI Ventures Pte. Ltd., which is a company headquartered in Singapore. The firm has very positive feedback from traders on Trustpilot, adding to the firm’s legitimacy. The firm was founded in 2024 making it a relatively young company. The firm also has only a few rules, which is rare in the prop trading industry, and only legitimate and reliable firms tend to use this policy. The firm allows access to a wide range of markets and a decent number of trading instruments: 6 metals, including Gold

- 3 energies including oil

- 10+ Forex pairs

- 14 indices

- 6 crypto assets including BTC and ETH

All these assets can be accessed through the cTrader platform which offers advanced tools.

PipFarm Forex Prop firm Brief Overview

PipFarm provides traders with a range of funding options from 10,000 USD to 200,000 USD with a scaling plan of up to 500,000 USD. The rules are very forgiving at PipFarm only requiring traders to follow a few risk rules. With a 90% profit share. PipFarm offers traders a unique opportunity to make money in trading with much larger capital than they can normally afford themselves.

Here are the main specs of PipFarm FX prop firm:

| FPA Score | Not yet rated |

| Year founded | 2024 |

| Headquarters | Singapore (The parent company is based in Singapore) |

| Minimum audition fee | 125 USD |

| Fees on withdrawals | Unknown |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 200,000 USD (up to 500k with scaling) |

| Allowed daily loss | 4% |

| Profit target | 12% |

| Maximum trailing drawdown | 8% |

| Profit sharing (Payouts) | 90% |

| Trading Platforms | cTrader |

| Available trading markets | Forex, commodities, indices, cryptos |

Safety of Pipfarm

PipFarm is young but has already managed to collect very positive reviews from its prop traders on Trustpilot. This is always an important aspect of evaluating the firm’s safety. If many traders are satisfied with its services and post good reviews then the firm might be legit and reliable. PipFarm has positive reviews, has no hidden rules, and only restricts traders from losing more than a certain percentage daily, making it reliable. PipFarm has no reviews on the FPA (Forex Peace Army) platform yet as it was recently established which might be a minor downside of the prop firm.

PipFarm Funding Options

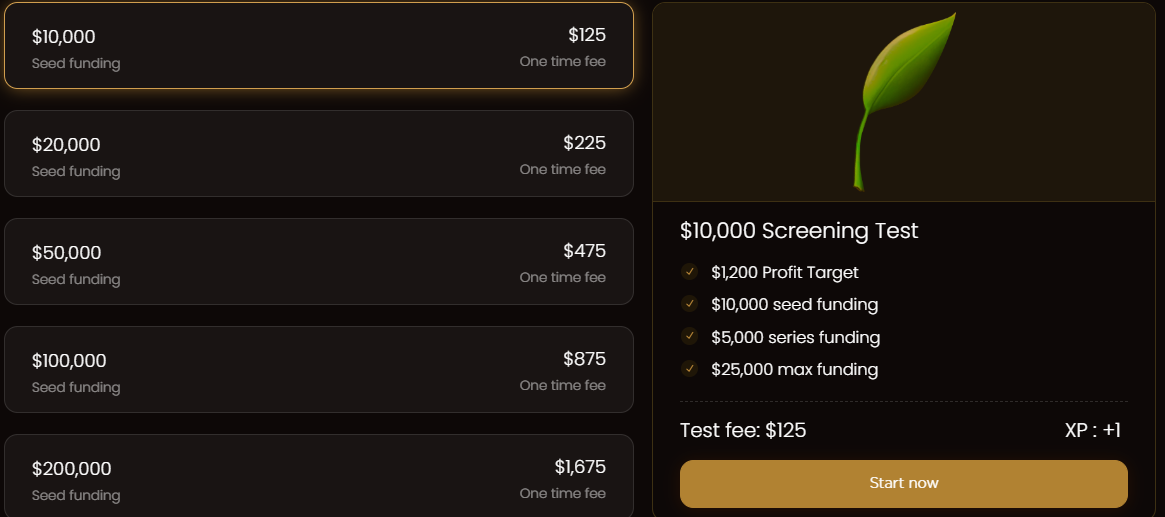

PipFarm offers diverse funding options starting from 10,000 USD with a maximum funding being 200,000 USD, and a scaling plan of up to 500,000 USD. PipFarm challenge provides traders with unique possibilities to start trading with the firm’s money and make a living without risking their own funds. PipFarm scaling plan is activated every 30 days and traders have to hit a 12% profit target to be able to scale their accounts. Despite this wide range of funding options, PipFarm is not offering 1 million and above funding options for now. PipFarm charges different fees for different funding amounts. Here is the list of funding options and fees:

- 10,000 USD — 125 USD

- 20,000 USD — 225 USD

- 50,000 USD — 475 USD

- 100,000 USD — 875 USD

- 200,000 USD — 1675 USD

Traders can use a discount code to get a 25% discount on their first purchase.

PipFarm Rules

PipFarm has only several rules, which is super beneficial for prop traders. The firm has no hidden rules, which is a critical aspect of PipFarm being legit. The rules are clear and described on the website of the firm, allowing traders to know every single rule before starting the challenge phase. The profit target is 12%, daily loss limit is set to 4% but can be increased to 5% after leveling up using PipFarm’s unique bonus system. Traders are allowed to employ any trading strategies except HFT (High-Frequency Trading) algorithms and trade copiers as their methods are very tricky and costly to replicate for the firm. The maximum drawdown is limited to 8%. Trading is allowed at any time of the day and traders are free to hold positions overnight, over the weekends, or trade during the major economic news. Crypto markets are tradable 24/7 which is super flexible. Here is the list of funding options and corresponding profit targets every trader has to hit to pass the evaluation challenge at PipFarm:

- 10,000 USD — 25,000 USD max funding — 1,200 USD profit target

- 20,000 USD — 50,000 USD max funding — 2,400 USD profit target

- 50,000 USD — 125,000 USD max funding — 6,000 USD profit target

- 100,000 USD — 250,000 USD max funding — 12,000 USD profit target

- 200,000 USD — 500,000 USD max funding — 24,000 USD profit target

PipFarm Platforms and Payment Options

PipFarm provides access to the advanced trading platform cTrader. It comes with a multitude of built-in advanced tools, including technical indicators and chart analysis tools. PipFarm allows traders to use automated trading algorithms or cBots except for HFT algorithms. PipFarm accepts wire transfers, bank cards, and a few online payment methods for faster deposit and withdrawal processes. The firm allows for quick 24-hour withdrawal processing.

PipFarm Bonuses and Promotions

PipFarm excels in its bonus and promotions events to supercharge trading experience for bits prop firms. A 25% discount awaits anyone on their purchase, further reducing the costs for starting to become a prop trader. The firm also has a ranking system, allowing traders to get various bonuses and add-ons for free after accomplishing quests and certain activities that have experience points. According to these points, there are 12 ranks in total, each of which provides unique bonuses:

- Rank 1 — No longer stop loss requirements

- Rank 2 — extended inactivity period from 14 days to 28 days

- Rank 3 — Series D funding to increase maximum funding even further

- Rank 4 — 50% lower commissions

- Rank 5–1:50 leverage

- Rank 6 — Payouts allowed at any time (processed under 24 hours)

- Rank 7 — Daily loss increased from 4 to 5%

- Rank 8 — 10% capital added to funded account

- Rank 9 — only 15 days between each scaling (instead of standard 30)

- Rank 10 — Free 100k test account

- Rank 11 — Absolute drawdown calculator changes from relative to absolute (fixed risk allowance)

- Rank 12 — Double scaling unlocked

Traders can get bonuses whenever they make 50 pips and 100 pips profits and these experience points are not deductible, meaning traders can only increase their experience level and get benefits.

PipFarm Education and Customer Support

PipFarm offers very limited educational materials. However, there is a blog and a FAQ section where traders can fully understand all the rules and important information about the trading challenge at PipFarm. There is a dashboard providing all the necessary tools to track a trader’s performance, which is a very useful tool in prop trading.

PipFarm customer support is excellent, providing both live chat and email support to quickly satisfy all the user needs regarding information and other trading-related inquiries.

PipFarm Review Conclusion

Overall, PipFarm presents itself as a solid choice for prop traders who want to pay very small fees and start trading on large funded accounts. The firm offers more than enough tools and an advanced trading platform cTrader with advanced capabilities including automated trading robots. Rules are simple, there are no hidden rules, and Trustpilot trader reviews are super positive. PipFarm really seems like a promising young prop firm that offers value to all traders with its bonuses and 25% discount on the first purchase.