Detailed review of Capital.com FX broker – Is it good?

Forex Trading has become one of the major industries all across the world. Forex trading is now the largest and most dynamic market. This is why it attracts so many people from different origins and backgrounds. Trading online is not a new phenomenon, though with the rapid development of technologies and the affordability as well as availability it has become more widespread to many countries.

While many people address different brokers for trading and the new opportunities, it should also be considered that not all of the brokers are reliable and not all of the brokers can be trusted. In order to find a proper broker, you have to visit some of them, check, compare, read some information and see how suitable are they for you. Whether you should or should not start a very complex journey. Within a lot of available brokers in the market, some of them perform better than the others. This is a very common thing and there is nothing surprising. Though before starting to trade you should learn how to differentiate the good broker from the bad broker.

Even if you have not thought about it yet, as you have just decided to trade online, we will help you in choosing a proper broker, who will be a guiding light through your journey. In this article, we will be talking about Capital.com’s broker. It is known to be one of the best brokers in the market, though even the best brokers have some major flows that you should be very attentive with.

Capital.com broker review

Once you enter the website, the first thing you will notice is loads of information. You might not be able to scroll down and read all of the information, as there is too much for that. Some of the information is very useful even if you are not trading, though most of the information is yet inconvenient and very irrelevant to the person who enters the broker’s webpage in order to create the account.

Once you enter the website, the first thing you will notice is loads of information. You might not be able to scroll down and read all of the information, as there is too much for that. Some of the information is very useful even if you are not trading, though most of the information is yet inconvenient and very irrelevant to the person who enters the broker’s webpage in order to create the account.

Navigation through the website is definitely managed in not the best way. It could have been a lot better. The first things I would love to know is the leverage, account types, and the registration for the account. Though none of the mentioned information is straight available at the home page. As the broker promises that the major reason for clients choosing exactly Capital.com is the simplicity and one-click performance, it is far from being a reality, or at least I counted my click in order to find the information and there were at least three of them.

While the design of the website is definitely very sophisticated and decent it very much looks like the Reuters. Thus, it gives you the impression of the news portal rather than a brokerage page. This is something very uncommon, as it delivers totally different vibe from what is needed. Other than that there are no concerns regarding the visual side of the webpage. The only thing is that too much information can be very disturbing and can be irrelevant to the main goal you have come for.

License and the background

The main thing to consider while choosing the broker is how safe and secure is it. In this case, the best thing to do is to check the license and check the registration number. With the registration number and the license, Capital.com has everything all right. They are licensed by the Financial Conduct Authority (FCA) and are registered in England, Whales. The registration number is also available at the bottom of the page. This is very good to know, as being licensed by the highest financial authority is definitely worth something.

The background of the company does not tell any different story. The company has been operating in the market for several years already. There are more than 350,000 costumers with Capital.com and there are several billion transfers made. This is definitely good statistics, though the broker with the very high title is still lower than some other top brokers in the market. This is all good until we switch to some other sections.

Trading

What have you come here for? Trading, is not it? The broker offers costumers several tools and instruments to trade with. There is nothing new but the cryptos, Forex, commodities, and indices. You should not be very excited as every good broker will offer you these tools to trade with. Here is all you need to know about the tools that the broker offers you.

What have you come here for? Trading, is not it? The broker offers costumers several tools and instruments to trade with. There is nothing new but the cryptos, Forex, commodities, and indices. You should not be very excited as every good broker will offer you these tools to trade with. Here is all you need to know about the tools that the broker offers you.

A stock market index is a measurement of a section of the stock market. It is calculated from the prices of selected stocks. Stock market indices are used by investors to describe the market and compare the return on specific investments. The advantage of trading indices is that they have multiple components. There are indices like the DAX that has 30 constituents, which measures the top-performing German stocks, or much broader indices like the S&P 500. Multiple components not only diversify risk to an extent, but they offer the opportunity for greater volatility due to the fact that there are simply more moving parts.

The FX market is one of the world’s biggest markets. You can trade currency pairs from every corner of the world. However, there are a handful of pairs that are worth mentioning: more traded than any other currency pairs, the ‘majors’ dominate the FX market. The four most traded currency pairs in the world have been coined the ‘majors’. They involve the following currencies: euro, US dollar, Japanese yen, and pound sterling. The most popular pairing is the EUR/USD, followed by the USD/JPY, GBP/USD, and USD/CHF pairs respectively.

There are a few other currencies that deserve to be mentioned. Informally known as the ‘commodity pairs’, the AUD/USD or ‘Aussie’, USD/CAD, and NZD/USD are all frequently traded currency pairs. Unsurprisingly, this group of currencies derives its nickname from the fact that they come from countries that possess large quantities of natural resources.

What is commodities trading? Commodities trading is the buying and selling of raw physical assets like wheat or sugar. Commodities are the building blocks of the global economy; they are the raw materials. There are two types of commodities – hard and soft. Soft commodities are those that tend to be grown such as coffee, cocoa, sugar, corn, wheat, soybean, fruit, and livestock. Hard resources are typically those natural resources that need to be extracted in some form. These include commodities such as gold, rubber, and oil.

Cryptocurrencies have the tendency to be particularly volatile, so they provide various opportunities for traders to open positions with big movements. Leveraged trading provides high liquidity, matched with the reputation cryptocurrencies have for being highly volatile.

Account Types

The most important thing while starting trading online is the account and the experience delivered by the account. You do not need an account, which will limit you in the practice and will be unsuitable for you. Usually, the best thing the brokers do is offer no deposit bonus accounts or demo accounts. Here we come, this is what the Capital.com does not prove you with.

The most important thing while starting trading online is the account and the experience delivered by the account. You do not need an account, which will limit you in the practice and will be unsuitable for you. Usually, the best thing the brokers do is offer no deposit bonus accounts or demo accounts. Here we come, this is what the Capital.com does not prove you with.

A demo account is one of the best opportunities for beginners to trade with. This is the account with the live, up to date market, though you are given specific virtual funds. This is not about making a profit form the fund, but rather learning how to trade and get acquainted with the market overall. This is something that gives you the best experience and you should definitely create the demo account, before switching to the live account. Unfortunately, Capital.com does not think about the development of the new traders and does not offer them this opportunity.

Another great opportunity which you will miss if registering with Caputal.com is the no deposit bonus account. This means that the broker gives you specific funds on your account, which is the real fund indifference with the Demo account. You have to trade with this fund at certain leverage. If you benefit enough, you can then withdraw your funds, though if you lose, the broker will not take any money from you, yet you will get a good experience. This is another great thing the Capital.com has not cared about.

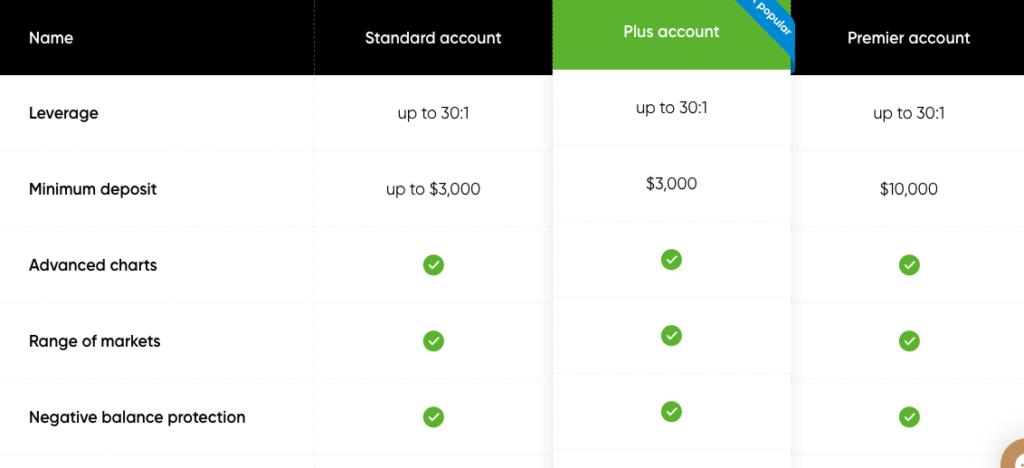

There are three accounts that the Capital.com broker offers the costumers. This is also a very small amount, usually, brokers have at least 4 types of accounts, while some of them have 8 and even more. The active accounts are the Standard, Plus Account, and Premier Account. The accounts do not differ with the leverage, which is up to 30:1. The minimum deposit is $3,000 the least for the standard and Plus accounts. The premium account is worth $10,000.

The major difference between those accounts is the number of features that can be used by the Premier account mostly. Those features include dedicated platform walkthrough, custom analytics, dedicated account manager, exclusive webinar, and premier events. All of the accounts have negative balance protection, meaning that you can never lose more than you have invested.

Deposits and Withdrawal

As you have read above, the minimum deposit is $3,000. Though, if we entered the FAQ section on the website, we will see that the minimum amount of deposit is $25 or any other equivalent currency. This does not mean that the broker is lying, it means that opening an account is worth $3,000, while after that you can deposit as little as $25.

As you have read above, the minimum deposit is $3,000. Though, if we entered the FAQ section on the website, we will see that the minimum amount of deposit is $25 or any other equivalent currency. This does not mean that the broker is lying, it means that opening an account is worth $3,000, while after that you can deposit as little as $25.

It should be mentioned that $3,000 is quite a valid amount of money. The new traders have to risk quite much while choosing this broker. While many other brokers offer accounts with the same features for relatively lower prices. Moreover, they also offer the bonuses and the demo account, which is a must thing to do for the new trader.

As for the withdrawal, the Capital.com accepts all types of payment methods. The payment methods include the credit and the debit card, as well as the e-wallets and the bank wire. There are no charges and fees for the withdrawal. Except for, the bank wire transfer. If you think of making the bank wire transfer for the deposit, you should consider that the minimum deposit, in this case, will be $250.

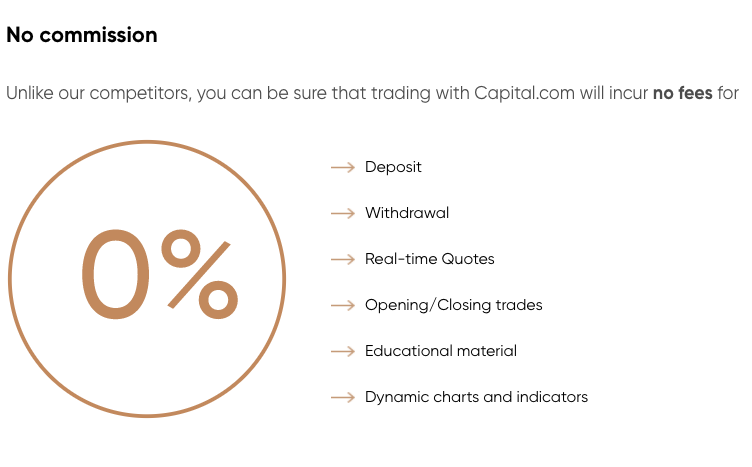

There are no charges for the withdrawal nor there are any fees for deposits or accounts. Unlike many competitors, Capital.com charges an overnight fee that is based on the leverage provided rather than the entire value of your position. As the overnight fee varies across instruments, you can find the specific overnight fee for your chosen instrument in the market information panel on the Capital.com platform.

Additional information

As mentioned in the beginning, the website looks perfectly like a news portal. There is a lot of news and there is a great educational section for the costumers. There are some webinars, and tutorials as well as some articles and information regarding the strategies and the methodologies. This is something that is worthy of your attention. So if you do not choose to trade with Capital.com make sure to read some of the information regarding Forex trading and the overall market.

As mentioned in the beginning, the website looks perfectly like a news portal. There is a lot of news and there is a great educational section for the costumers. There are some webinars, and tutorials as well as some articles and information regarding the strategies and the methodologies. This is something that is worthy of your attention. So if you do not choose to trade with Capital.com make sure to read some of the information regarding Forex trading and the overall market.

The broker does not operate with the MT4 or MT5 platforms, which are most commonly used for trading online. On the contrary, they have their own platform, which is very individual and might be another sign of concern. While MT4 and MT5 are very well known and adapted to the market. the information regarding the usage and the instruction is widely available. While the personal platforms are a bit more tricky and need some time to get used to. Though, without having a demo account and bonuses it means that you might lose some time and money in the process of adaptation.

Summary

There are a lot of brokers available in the market. Some of them are performing batter, while others are performing a bit worse. The main disadvantage of the Capital.com broker is that it is mainly focused on the old traders and traders who know what to do. They have offers and the best features for the traders who have been trading for quite some time already and are ready to risk a lot of money.

The broker is not a very new customer-friendly. Despite the fact that there is a lot of information available regarding the market, it still doe snot mean that the newcomers will understand the market and will be happy to start trading with Capital.com.

If it is your first time, or if you are only the beginner and want to learn without risking a lot of money at first, then this broker is definitely not for you. With Capital.com you should have whether a lot of money to spend, a lot of experience, or both.

Software: Web Based

Software: Web Based Currencies: USD, EUR, GBP, AUD, CHF, BTC, ETH

Currencies: USD, EUR, GBP, AUD, CHF, BTC, ETH Payment Methods: Bank Wire, Visa, MasterCard, Neteller, Paypal, Skrill, BTC

Payment Methods: Bank Wire, Visa, MasterCard, Neteller, Paypal, Skrill, BTC