AvaTrade Review – Choose among 1250 financial instruments

AvaTrade is the broker of choice for over 300,000 traders worldwide. The broker provides its services to global clients for over 15 years now. Operating in more than 100 countries internationally, AvaTrade is one of the leading Forex brokerage firms in the industry.

The portfolio of the AvaTrader Forex broker includes more than 1250 financial instruments. Therefore, traders do not need to worry over the lack of choice when it comes to finding their desirable trading asset. Apparently, the broker’s efforts and exceptional service provision did not go unnoticed. AvaTrade won dozens of industry awards and recognitions from the top financial institutions around the globe. Apart from it, the broker holds licenses and authorization from some of the most reliable official authorities and regulatory bodies. That is why AvaTrade is considered one of the most secure and safe brokers out there.

However, without going in-depth about the brokerage services that AvaTrade provides, it is difficult to say that this broker is the best one for you. There are various types of traders out there who have different styles of trading and trading strategies, specific condition requirements, and risk tolerance. Therefore, it would be extremely helpful to go through the detailed observation of the broker and see if it suits your needs and demands. Follow our review on AvaTrade Forex broker to check what the broker has to offer.

Overview of AvaTrade

Being one of the best multi-national brokerage companies, AvaTrade has a number of representative offices registered in various locations across the globe. The main headquarters of the brokerage firm can be found in Paris, Dublin, Milan, Toky, and Sydney. However, the company is originally based in Dublin, Ireland. The history of the broker goes back to 2006 when it was initially established and since then, AvaTrade has grown significantly.

At the moment, the number of active users registered on the trading platform of AvaTrade exceeds 300,000 clients. According to the official statistics, the brokerage executes over two million trades every month. To better understand the size of the company’s business, let’s look at the numbers. AvaTrade has a trading volume of over 70 billion US dollars every month, which is quite a competitive amount.

While working on our AvaTrade Forex broker review, we observed that the broker is dedicated to providing the highest-quality services to traders of every possible background. No matter if you are a complete beginner, intermediate or expert trader, the broker knows how to assist you and what to provide to you to make the trading environment as convenient for you as possible. Due to the broker’s excellence of services over a decade, AvaTrade has earned more than 30 industry awards, which makes it one of the most recognized brokerage firms on the market.

Regulatory Framework of AvaTrade

No one can diminish the significance of the legal and regulatory frameworks when it comes to trading Forex. The unregulated markets have proved historically that such an environment is highly damaging to the clients’ funds and leads to a plethora of identity and money laundering crimes. Therefore, the majority of the top Forex brokers worldwide would put considerable effort into developing their legal frameworks.

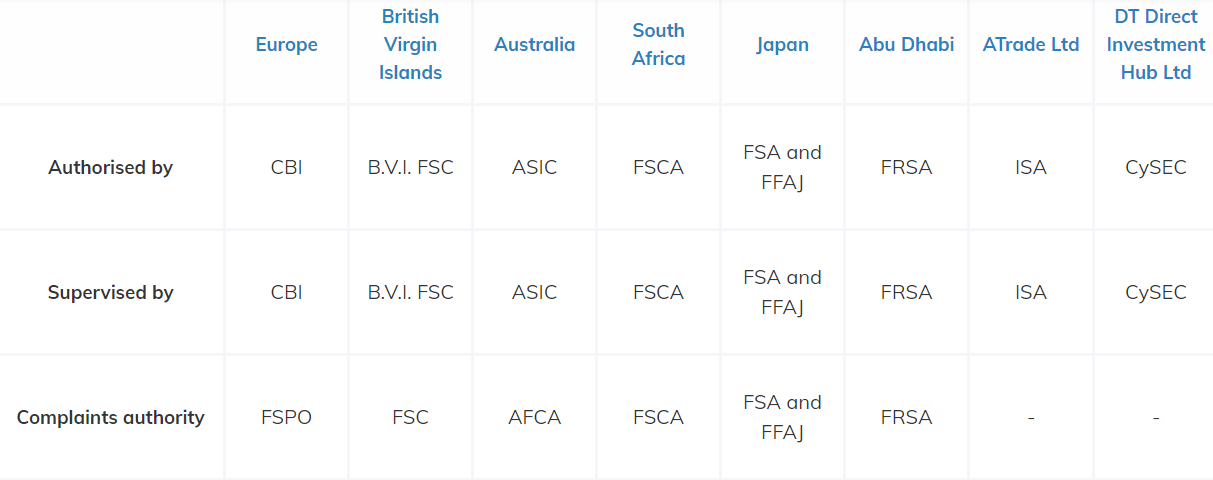

AvaTrade has once again demonstrated its commitment towards the traders and has managed to obtain authorization from the leading regulatory bodies around the globe. At the moment, the broker holds six licenses from the most recognized authorities making AvaTrade a legal, secure, trustworthy, and transparent broker.

In almost every region, the broker has a respective regulatory organ recognizing the brokerage firm as a lawful and legit company. For example, in Europe, AvaTrade holds a license from the Central Bank of Ireland, which serves as the principal regulator of the country. The broker is regulated according to the derivatives of MiFID which requires the firm to comply with the highest market standards of security. In other regions of the world, AvaTrade broker is regulated by the following authorities:

- Australian Securities and Investments Commission, ASIC

- British Virgin Islands Financial Services Commission, FSC

- The Financial Sector Conduct Authority of South Africa, FSCA

- Financial Services Agency, FSA

- Financial Futures Association of Japan, FFAJ

- Abu Dhabi Financial Services Regulatory Authority, FSRA

Security of Funds at AvaTrade

The primary tool of the security of clients’ funds and protection of the traders’ rights is the regulation. As we have already observed, the broker holds licenses from multiple regulatory bodies, which somewhat already underlines the safety of the financial resources of traders with the broker. How regulations guarantee safety is not difficult to understand. Most of the regulations require the broker to undergo regular checks or audits of the company. Usually, these audits are carried out by members of Big Four accounting firms. These audits make sure that the broker complies with all the standards set by the regulatory organs and that it keeps sufficient funds on the accounts.

In addition to this, AvaTrade Forex broker keeps segregated bank accounts for its clients. It is once again strongly required from the regulatory authorities worldwide. The reason behind this is that in case the broker goes bankrupt or is not able to satisfy the financial needs of the clients, traders will not be hurt. Meaning that, the segregated accounts guarantee that there will always be sufficient finances on the accounts to refund or compensate for any loss or damage caused by the broker itself.

Furthermore, Negative Balance Protection is the concept that many Forex traders would like to hear from their brokers. Usually, the high leveraged Forex market is associated with significant risks, therefore, some of the traders might be losing more financial resources than they actually have available on their accounts. To avoid this issue, AvaTrade implements the feature of Negative Balance Protection which avoids clients’ accounts entering the negative value. The broker will close the positions automatically as soon as they get close to zero.

Types of Accounts at AvaTrade

When we did the review of AvaTrade we noticed that the broker has different approaches to different kinds of traders. The account types that the broker provides is suitable for the traders with various needs, styles, and experience. In order to start trading with the broker, you will need to register a live trading account, most likely on the Standard account type. You will also have an option to create an Islamic account that comes with specific conditions and benefits for Muslim traders.

When we did the review of AvaTrade we noticed that the broker has different approaches to different kinds of traders. The account types that the broker provides is suitable for the traders with various needs, styles, and experience. In order to start trading with the broker, you will need to register a live trading account, most likely on the Standard account type. You will also have an option to create an Islamic account that comes with specific conditions and benefits for Muslim traders.

Within the standard account of the broker, traders can access all 1250 financial instruments without any restrictions. The leverage for these account holders is actually calculated according to the formula and depends on the size of the trader’s equity. Unlimited leverage will be available for the traders whose equity is less than 999 US dollars or equivalent in other currency. Similarly, as equity keeps growing, the leverage correspondingly decreases. As for the spreads on different assets, the broker designs a special formula for the total spread cost, which is based on the trading volume and individual spread of an asset.

Professional account, as the name suggests, is for the expert traders who are well experienced and accustomed to the world of Forex trading. It is a special premium account for the clients, which considerably increases the AvaTrade rating. Holders of this account can access much more flexible leverage and trading conditions with various opportunities and additional benefits attached to the account. However, not every trader can qualify for a professional account. There are certain terms and conditions that decide the eligibility criteria of the traders for this account type. First of all, the traders should have completed certain trading volumes in the past 12 months with the broker, and their financial instruments portfolio should be at least 500,000 EUR or equivalent in other currencies. This includes both cash savings and financial instruments.

Why AvaTrade offers an Islamic account? According to Sharia law, payment and receipt of interest rates are strictly prohibited. While some of the trade types do not incur interest rates, such as day trades which involve opening and closing the position within the same trading day, most of the positions are held for over 24 hours. According to the business model of the Forex brokers, any position that is open for more than 24 hours is charged for rollover fee. Therefore, overnight positions of Muslim traders would be liable for overnight fees, which goes against their religious laws. Accordingly, the broker frees Islamic accounts from swap fees, in order to make trading more convenient for them.

Trading Assets Portfolio of AvaTrade

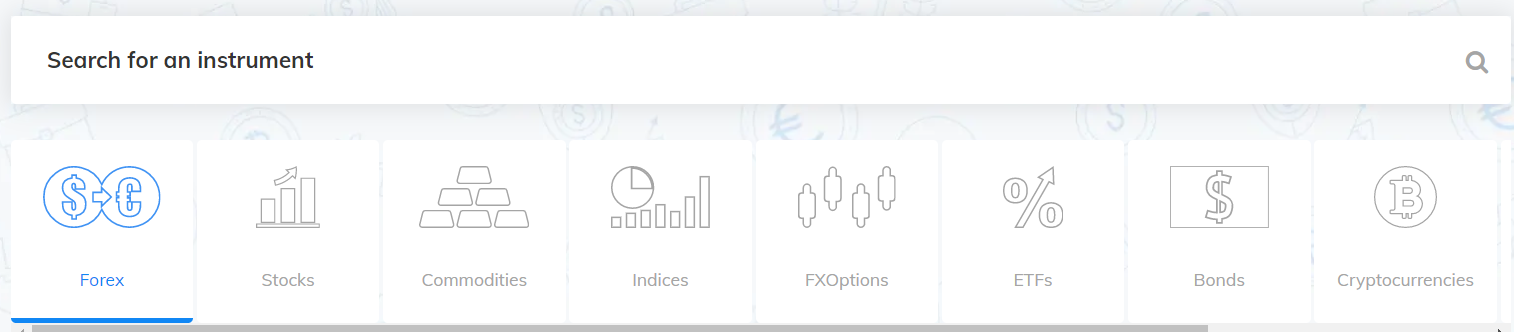

The diversity of the trading portfolio is one of the benefits that the broker can introduce to its clients. Usually, different clients with distinct financial capabilities will be choosing different financial instruments for their portfolios. That is why combining several financial markets is always a good idea for the broker. AvaTrade offers numerous trading instruments on its trading platform. The clients of the broker can access the following trading assets:

- Forex

- Cryptocurrencies

- CFDs

- Commodities

- Stocks

- Indices

Currency Pairs

Forex is the largest, busiest, and probably one of the most volatile financial markets in the world. As millions of users trade Forex nowadays with trillions of transactions occurring on a regular basis within the Forex market, AvaTrade directs its greatest effort to trade currency pairs. Within the portfolio of Forex currency pairs of the broker, traders can find some of the most popular and common pairs, as well as the several exotic currency pairs. The corresponding conditions of trading for these Forex assets are quite competitive with tighter spreads than the market average, flexible leverage, and various trading tools.

Cryptocurrencies

As many people like to think, cryptocurrencies are coins of the future. More and more traders sign up on the platforms to trade cryptos, which are highly volatile and greatly reward the winners while causing major losses for the losers. However, in AvaTrade opinion, clients should be able to access the cryptocurrencies on its trading platform with some of the most competitive trading conditions. With AvaTrade, clients can choose from the most popular cryptocurrencies such as Bitcoin, Ethereum, Dash, Bitcoin Cash, Ripple, Liteconi, Stellar, NEO, and many more.

In contrast to many other brokers, AvaTrade allows its customers to trade cryptocurrencies without any commission charges. Additionally, there are no bank fees on transactions which makes trading cryptocurrencies relatively cost-efficient. The leverage depends on the geographic location of the trader, as in the European Union, due to regulatory restrictions, the broker can offer leverage maximum of up to 1:2. However, the leverage for non-EU residents can be as much as 1:25. The broker also has a feature of stop-loss orders which significantly reduces the risks associated with trading cryptos. Traders also have an option to trade cryptocurrencies against Fiat currencies, such as USD and EUR.

Commodities

The commodities market is another large and highly popular market among both experienced and beginner traders. The market itself divides in two with soft and hard commodities available on the platforms. AvaTrade broker provides both options for its clients – trading soft commodities and trading hard commodities. Soft commodities are the products of agricultural activities and include assets like sugar, coffee, and wheat, whereas hard commodities are precious metals and energies, such as gold and silver, or crude and brent oil.